Better Resume.

Faster Search. More Offers.

Simplify your job search and land your next position sooner with Teal's all-in-one suite of tools.

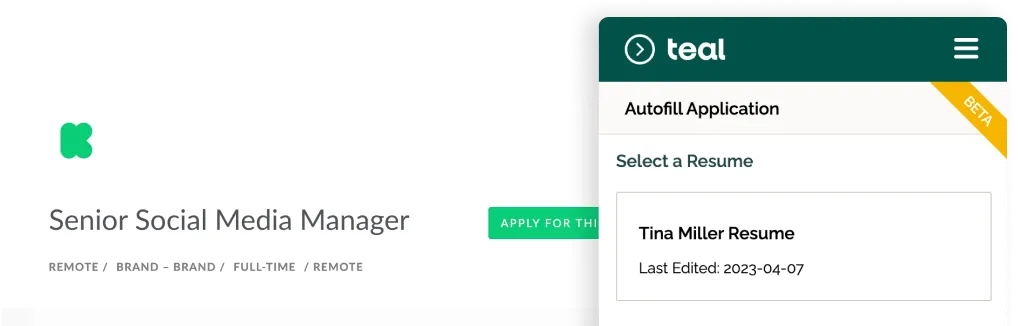

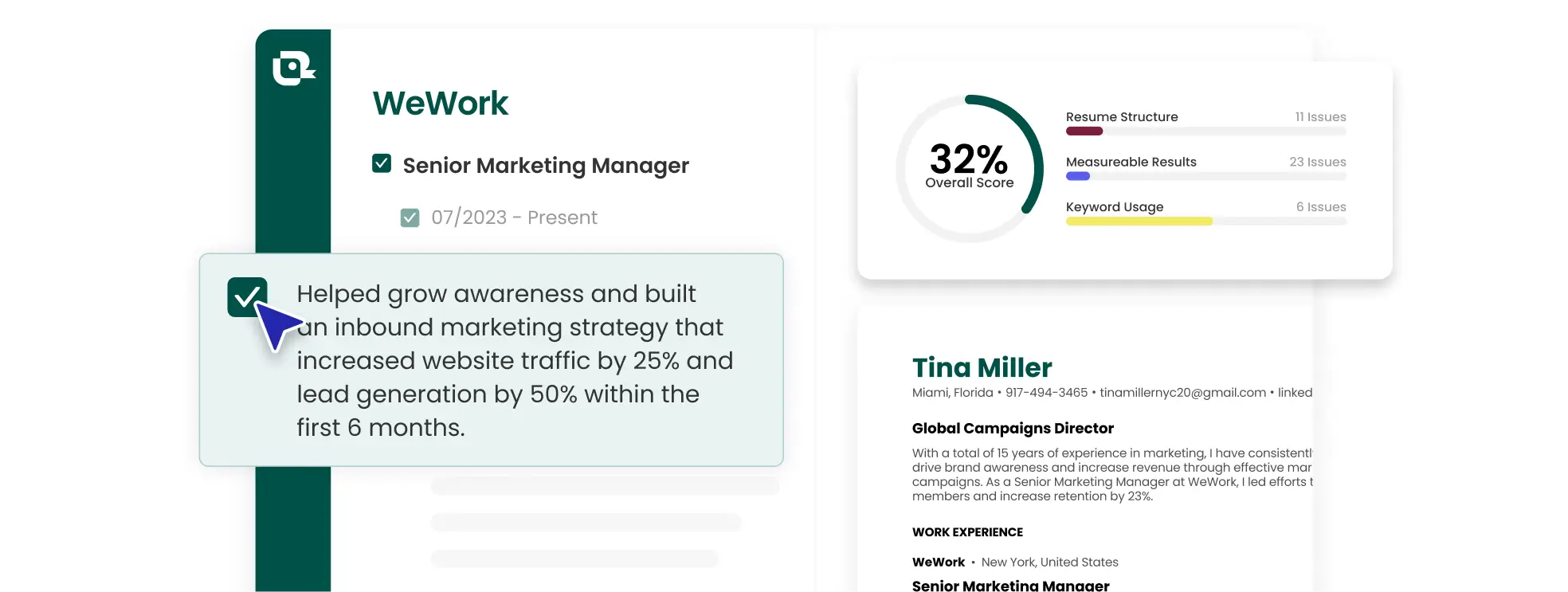

AI Resume Builder

Quickly tailor your resume for each job application

Use the right keywords from job descriptions to highlight your qualifications on your resume. Get recommendations to improve your resume and land more interviews.

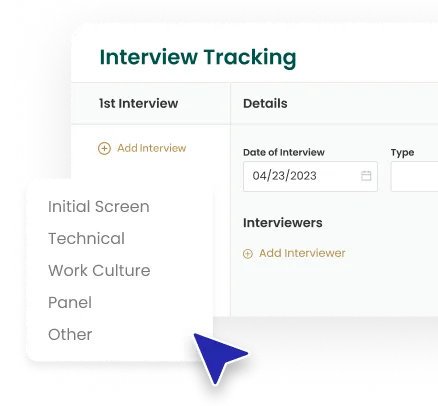

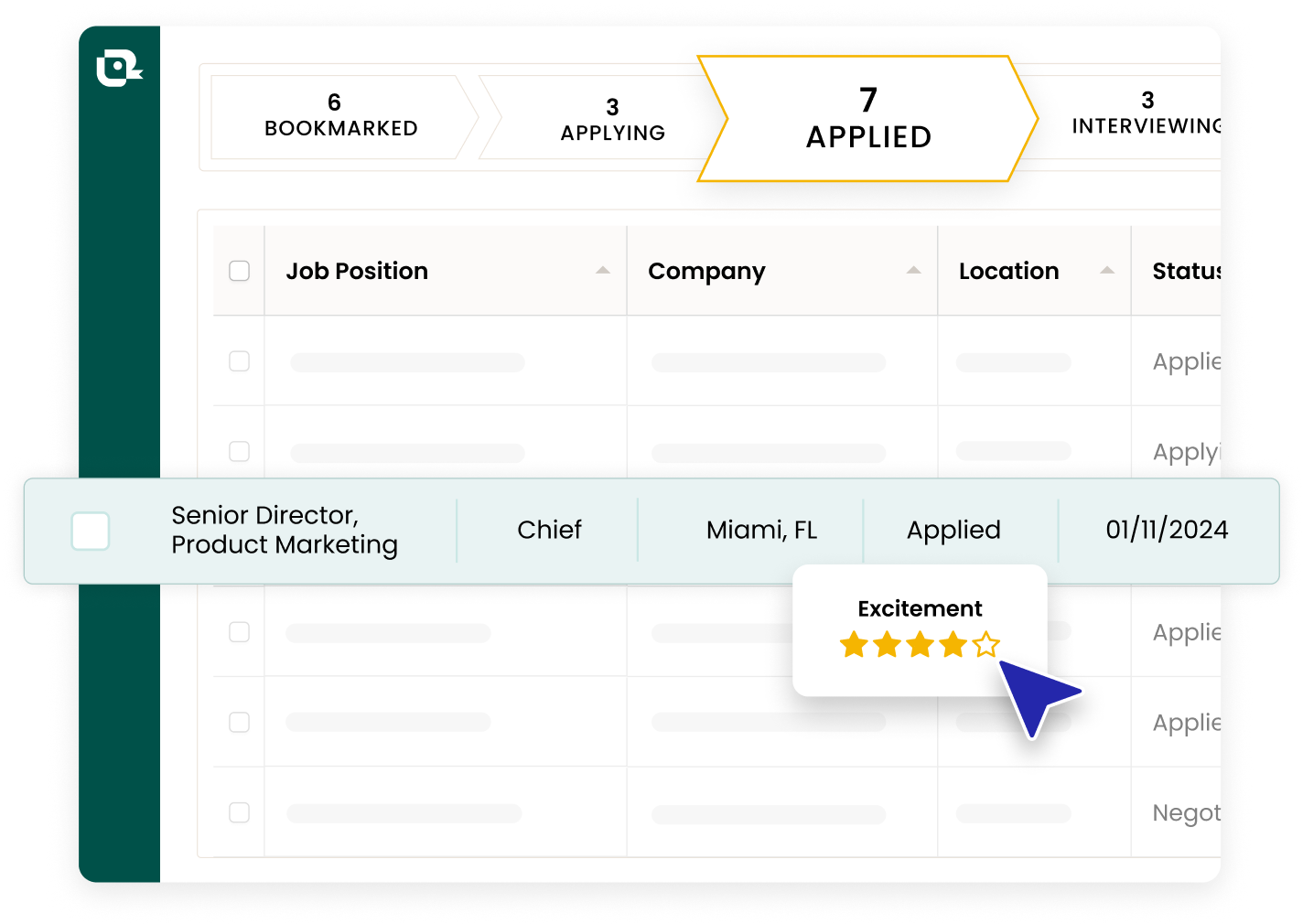

Job Tracker

One place to organize and manage your job search

A fast and easy way to keep track of all your job opportunities in one place.

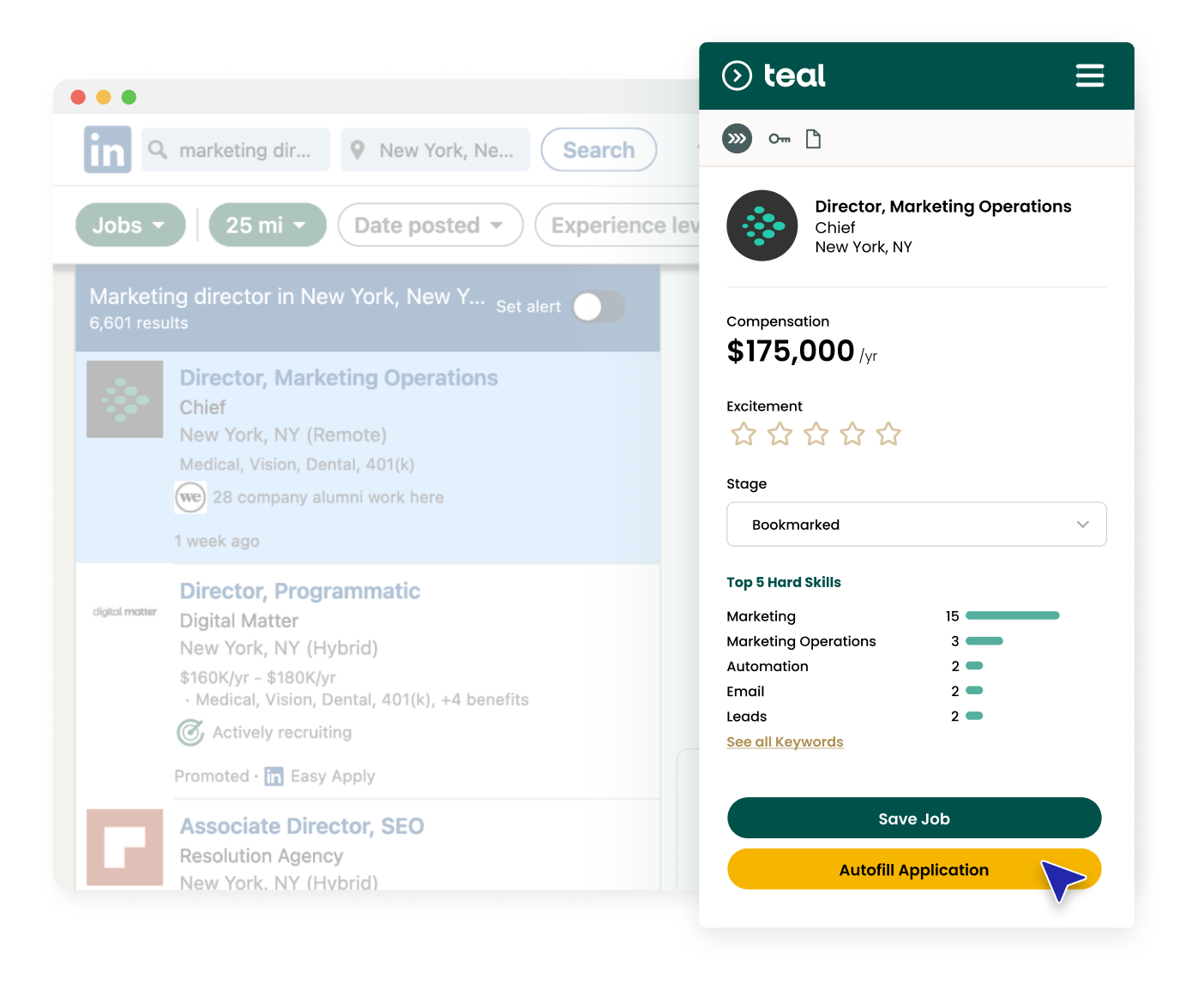

Bookmark jobs from any job board using Teal’s Chrome extension to save you time and keep you on track.

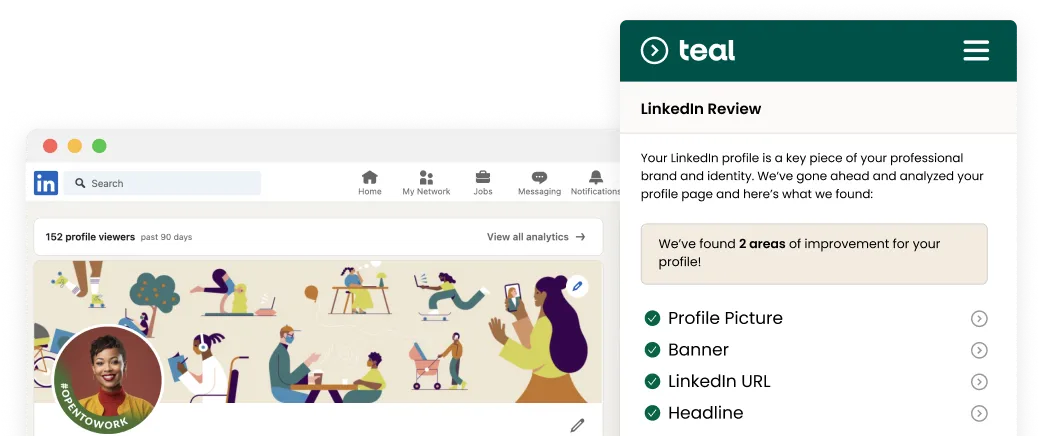

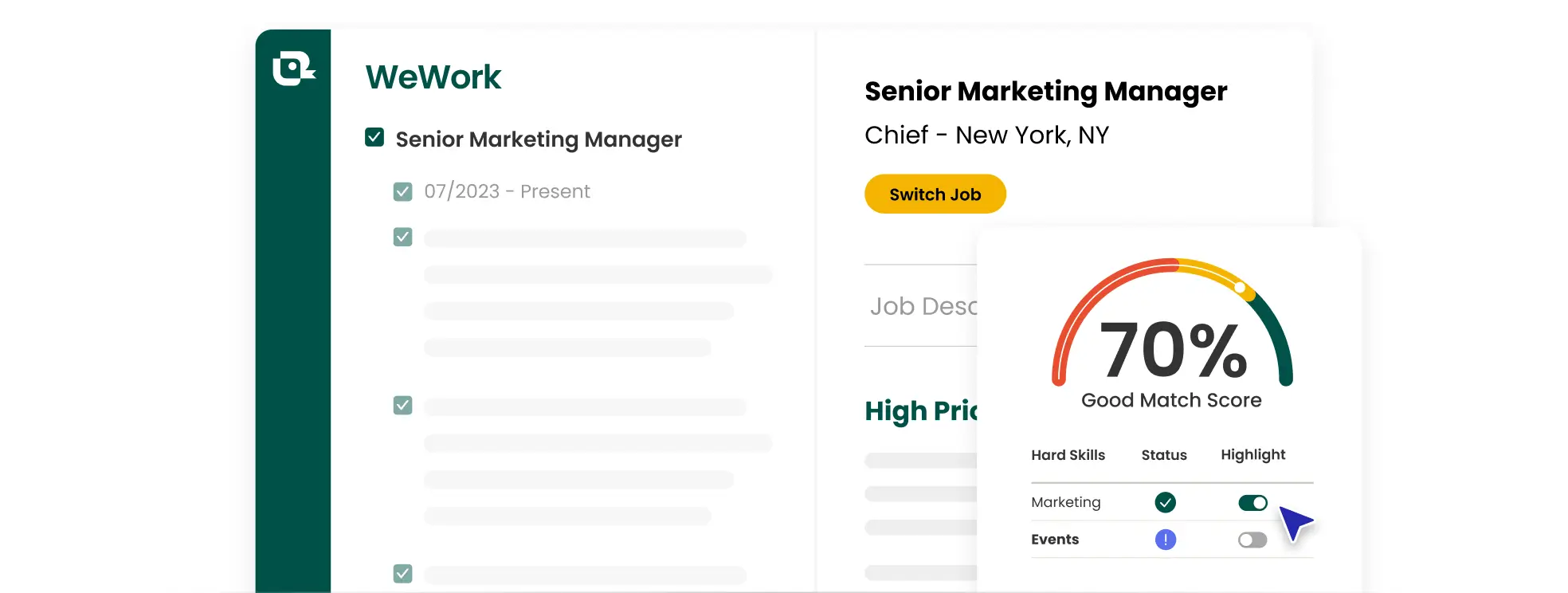

Job Insights

Companies have recruiters, and you have Teal

Save time by automating parts of your job search with insights and recommendations. Never miss an opportunity by planning and tracking your job search all in one place.

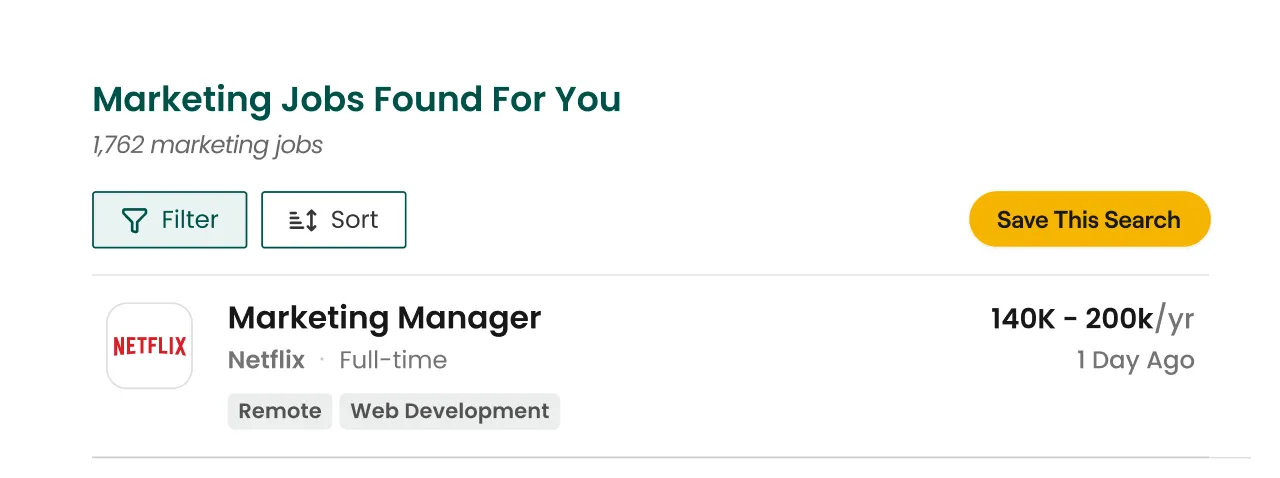

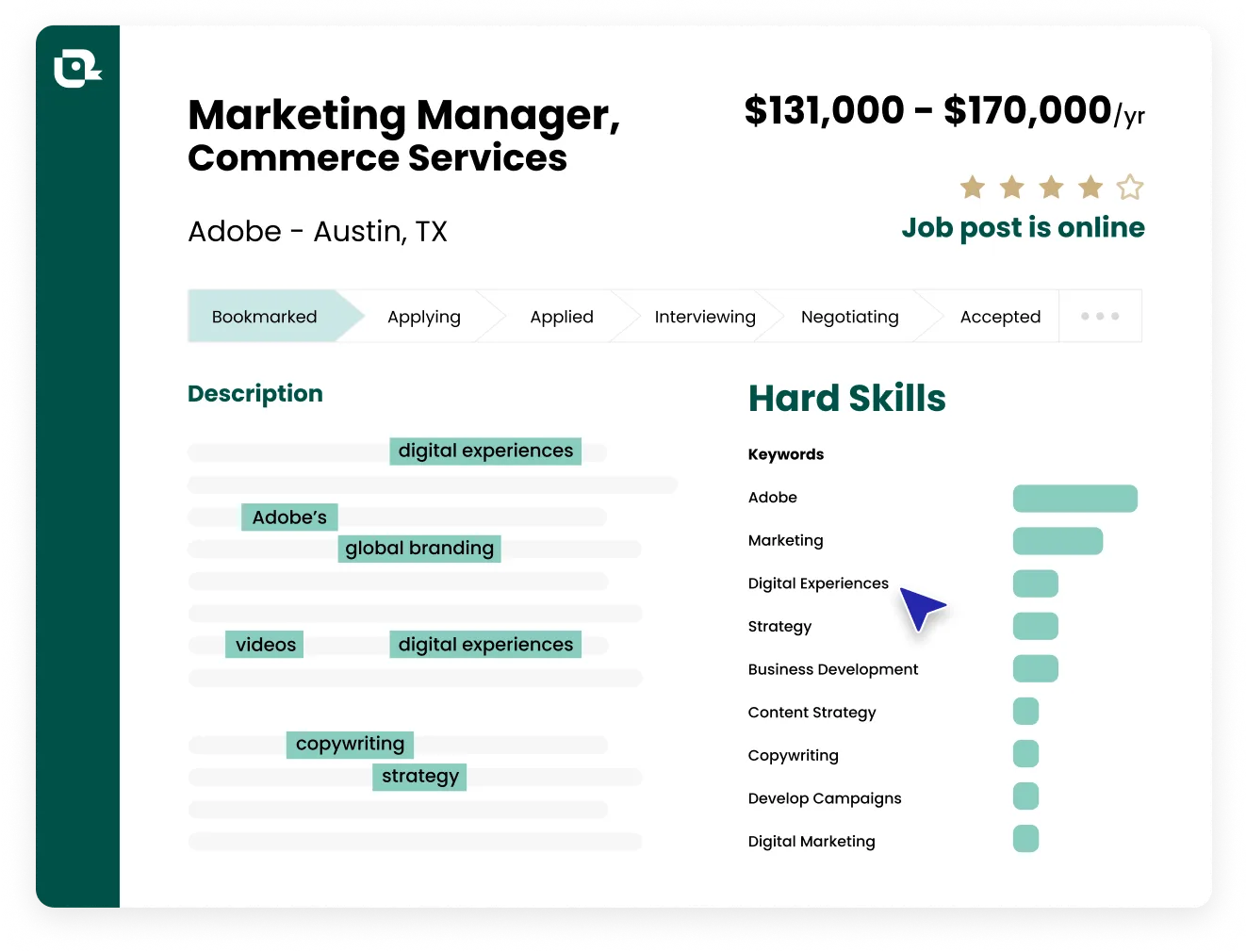

Bookmark Jobs

Save Jobs From over 40 Popular Job Boards

The free Chrome extension is designed to run an efficient job search so you can land a job faster. Get recommendations to improve your resume and land more interviews.

Other Teal features

Join thousands of Teal members, leveling up their career

You guys are a job seeker’s best friend!

I absolutely love the Teal platform

Teal, you’ve become a household brand

Job searching a smidge less stressful

Teal’s simplicity is it’s strength

I understand the hype now

I am blown away by the abilities Teal offers

Within less than a week I’ve fallen for this product hard

Happy Teal user

Teal’s simplicity is it’s strength

You guys are a job seeker’s best friend!

You guys are a job seeker’s best friend!

I absolutely love the Teal platform

Teal, you’ve become a household brand

Job searching a smidge less stressful

Teal’s simplicity is it’s strength

Within less than a week I’ve fallen for this product hard

Need to level up your career even faster?

Upgrade to unlock Teal's premium features and turbocharge your job search.

- Unlimited Resumes

- Unlimited Resumes Templates

- Unlimited Job Tracking

- Top 5 Keywords

- 1 Email Template Per job stage

- Basic analysis in the resume builder

- Basic Resume Keyword Matching

Free

Forever

- Everything in Teal Free

- Unlimited Advanced Resume Analysis

- Unlimited Resume Keyword Matching

- Unlimited keywords (hard and soft skills) listed in the job tracker

- Unlimited Email Templates

- No ads across the entire platform

- 24/7 Email Support

$9 / Week

Billed every week, month or 3 months